Credit card debt

Credit card debt

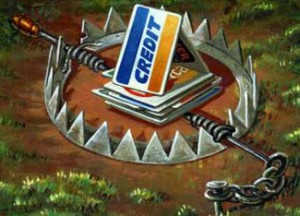

Ever increasing credit card debt can give any card holder sleepless nights. Credit card is one form of money which facilitates impulsive purchases. More often than not, the card holders falls in the trap and incur a huge outstanding on their credit cards. At times they might assume monstrous proportions, so much so that the card holder may find it increasingly hard to pay back the outstanding credit card debt. Credit card companies generally levy a huge amount of interest rates thus amplifying the problems further.

There are various credit card debt solutions which can work for you-

*Debt relief- This is an option wherein the credit card company foregoes a certain percentage or the whole of the outstanding. This option is a hard nut to crack with most of the credit card companies.

*Debt settlements- Debt settlement entails negotiating with the credit card companies for a lower principal amount and if possible a lowered interest rate and late fees too. The lowered outstanding is generally paid at one go instead of spreading it over months and years.

*Debt consolidation- wherein outstanding on various credit cards are clubbed into one and loan sought, generally at lower rate of interest than what these loans incur, for the purpose of pay back.

*Pay offs- this entails reworking the interest rates and the payment schedule of the card holders. In case the card holder is ready to pay back the outstanding in amounts as much as he can, interest rates and the payment schedule are generally reworked so that the card holder becomes debt free as soon as possible.

Other credit card debt solutions would include-

~ Borrowing from friends and families to pay off the debt. This generally does away with interest rate and hard and fast payback time.

~ Paying off the loans which levy a higher rate of interest- if a card holder does his homework thoroughly and marks out the debts which have a higher rate of interest, he can work out a schedule wherein he pays off the debts which cost him dear.

~Trying not to buy the credit card insurance, since it gets very expensive opting for one.

~ When consolidating a loan, researching thoroughly on the interest rates. Avoiding home refinancing loans, as they eat more into your pie than they would seem to.